Make an Appointment

Turnover is something every small business owner should understand. Yet, knowing what turnover in business is seems to be met with more confusion than anything.

Turnover is something every small business owner should understand. Yet, knowing what turnover in business is seems to be met with more confusion than anything. What is meant by turnover in business depends on the context as it can refer to definitions both in terms of accounting and HR.

So, to give you a better understanding of business turnover, here, we’re going over what it actually means, how it can be meant in different contexts, and how it’s different from revenue. Let’s get started!

What is turnover in business?

Turnover in business most often refers to the income your business makes. It’s a number used in accounting to reflect how much a business makes during a sales period. However, not everyone agrees on what exactly turnover means. Is it your overall income? Is it your net sales? Is it the same as revenue?

Although the answer is unclear, in general, business turnover is the net sales of a business while revenue or profits are the residual earnings of a business after all expenses have been compared against the turnover.

It’s important to understand your turnover rate because it tells you how well your products or services are selling. However, it’s equally important to understand that your turnover is different from your revenue. For example, if your turnover is less than your expenses, it means your business isn’t profitable and ultimately won’t last if you continue down the same trajectory.

Overall, turnover helps you clarify trends, know what’s working and what’s not, and can help you create a feasible budget for your business.

What is meant by turnover in business?

Turnover in business usually refers to the rate at which assets of a business sell or exceed their useful life. However, it also refers to the rate at which employees leave your business. Hence, what is meant by turnover in business depends on the context in which it’s used.

For accounting purposes, turnover is your business income or the net sales of your business. For HR purposes, on the other hand, turnover means how quickly employees are leaving your company.

We’ve already mentioned the importance of understanding turnover in terms of income for your business. But turnover from the HR perspective is also important to consider.

When your small business experiences a high turnover rate with many employees deciding to leave your company in a short amount of time, you’ll want to pay attention to.

First of all, it’s expensive to continue to train new employees each time one of your current employees decides to leave. Next, it could be a sign of poor management, salary issues, or another failure on your part.

What is annual turnover in business?

In simpler terms, annual turnover refers to your business’s yearly income received as a result of sales from your goods and/or services and any income earned from the sale of business assets or income from other entities connected to your company. Business turnover is the number you’ll declare on your annual tax return for your business income.

According to the Australian Government, annual turnover is “the ordinary income that you derive in the income year in the course of running your business”. However, the ATO also uses a term called “aggregate turnover” which is what they mean when they say “turnover” on its own.

Aggregate turnover is “your annual turnover (all ordinary income you earned in the ordinary course of running a business for the income year) plus the annual turnover of any entities you are connected with or that are your affiliates”.

While your business accountant will likely keep track of your business turnover for each month as well as on a yearly basis, all of this data is important.

When you see your turnover rate on a monthly basis, you can better understand which months were successful and which were less so. From there, you might make different decisions based on the time of the year, when you set your biggest sales, or when you might need to beef up your marketing efforts.

On the other hand, annual turnover is crucial because this rate helps you to secure investments, take out loans, and helps to decide the overall value of your company. Like it or not, the bottom line comes down to cold, hard numbers and your annual turnover is probably your business’s most important number besides profits.

What is the difference between turnover and revenue?

The difference between turnover and revenue is that turnover refers to the gross income of your business while revenue refers to the net income of your business.

Gross income is the money received from sales of your goods and/or services. This amount is the total income earned.

Net income, on the other hand, is the total amount of money received from sales after expenses. Revenue, therefore, is the amount of profit you made from your business after you take into account the money you earned and the money you spent to keep your company running.

Both of these numbers are important. Turnover helps you understand what’s selling, what’s not, and when certain products or services are selling the most. Revenue helps you understand when you’re spending too much, how you can better budget your money, and whether or not your business is actually profitable.

The point is, your business could be raking it in with turnover numbers that are sky high. But if your expenses are even higher, it means your company isn’t making a profit.

Overall, the goal is to ensure that you’re making more money than you’re spending. And although, especially during the first few years, your expenses might exceed your turnover, the goal should always be to earn revenue.

How to calculate business turnover?

To calculate your business turnover, decide on a specific time period and add together the money received from the sale of goods and/or services. If you keep accurate records (which you should), calculating business turnover is a straightforward process.

How to calculate business revenue?

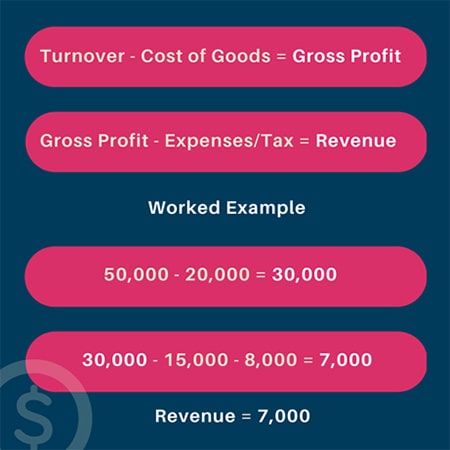

Calculating business revenue requires deciding on a specific time period, adding together the money received from sales of goods and/or services, and then deducting all other expenses including the cost of the goods themselves, operating expenses, and tax liabilities.

For example, you can use this calculation to figure out your business revenue:

Again, the goal for your business revenue is to stay out of the “red”. When you’re in the “red”, it means your expenses exceed your turnover. However, it might happen in the beginning, so don’t get discouraged.

Date Published: Thursday, July 8, 2021

Date Modified: Tuesday, July 16, 2024

Need to get into direct contact with ur Client Services team? We're all ears. Call our team directly on 1300 731 733